Residential Services

Why Switch to Natural Gas?

Switching to natural gas means never having to worry about fuel deliveries again. Learn about how natural gas can provide direct, environmentally-friendly, and cost-effective energy for your home.

Bill Payment Assistance is Available

Help is available if you need assistance paying your natural gas bills. Financing is available to eligible Nicor Gas customers to cover the cost of energy efficiency equipment and improvements in their homes.

Understanding the Current State of Natural Gas

The cost of natural gas service has risen around the world due to increase demand during the COVID-19 pandemic and ongoing global tensions. At Nicor Gas, we understand how challenging this is and are committed to providing resources that help meet the most basic needs for paying your utility bill and beyond.

Understanding the current state of natural gas

Find a Contractor

Need help with a job at your home, apartment building, commercial property, or industrial or manufactoring facility? Use our simple tool to find a contractor near you in just 3 easy steps.

Start Your Search

Payment Options

We offer a wide variety of bill payment options for your convenience, including Online Paperless Billing. Save time, stamps and trees by enrolling in our paperless billing option. AutoPay. Safely and conveniently have your bill payment automatically deducted from your bank account or credit card each month for free.

Find the right payment option

Save Money with Energy Efficiency

You deserve to save energy without sacrificing comfort. See how our rebates for efficient equipment make it more affordable to upgrade, so you can stay comfortable year-round.

Learn More about Rebates

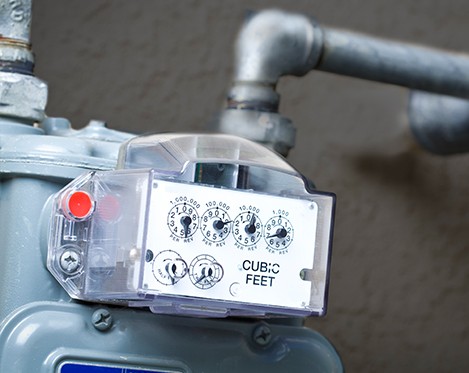

Reading Your Meter

Nicor Gas automatically reads residential, commercial and industrial meters. This is possible due to meters that have been upgraded with two-way communications devices that enable meter reads to be obtained without the need for a field visit. A small percentage of meter reads are still obtained by a meter reader that visits your home or business notating the amount of natural gas you use and generating your utility bill.

Find Out MoreUnderstanding Your Residential Bill

Understanding your bill can be confusing, but it doesn't have to be.

Find Out More